The rising cost of living threatens our prosperity and quality of life.

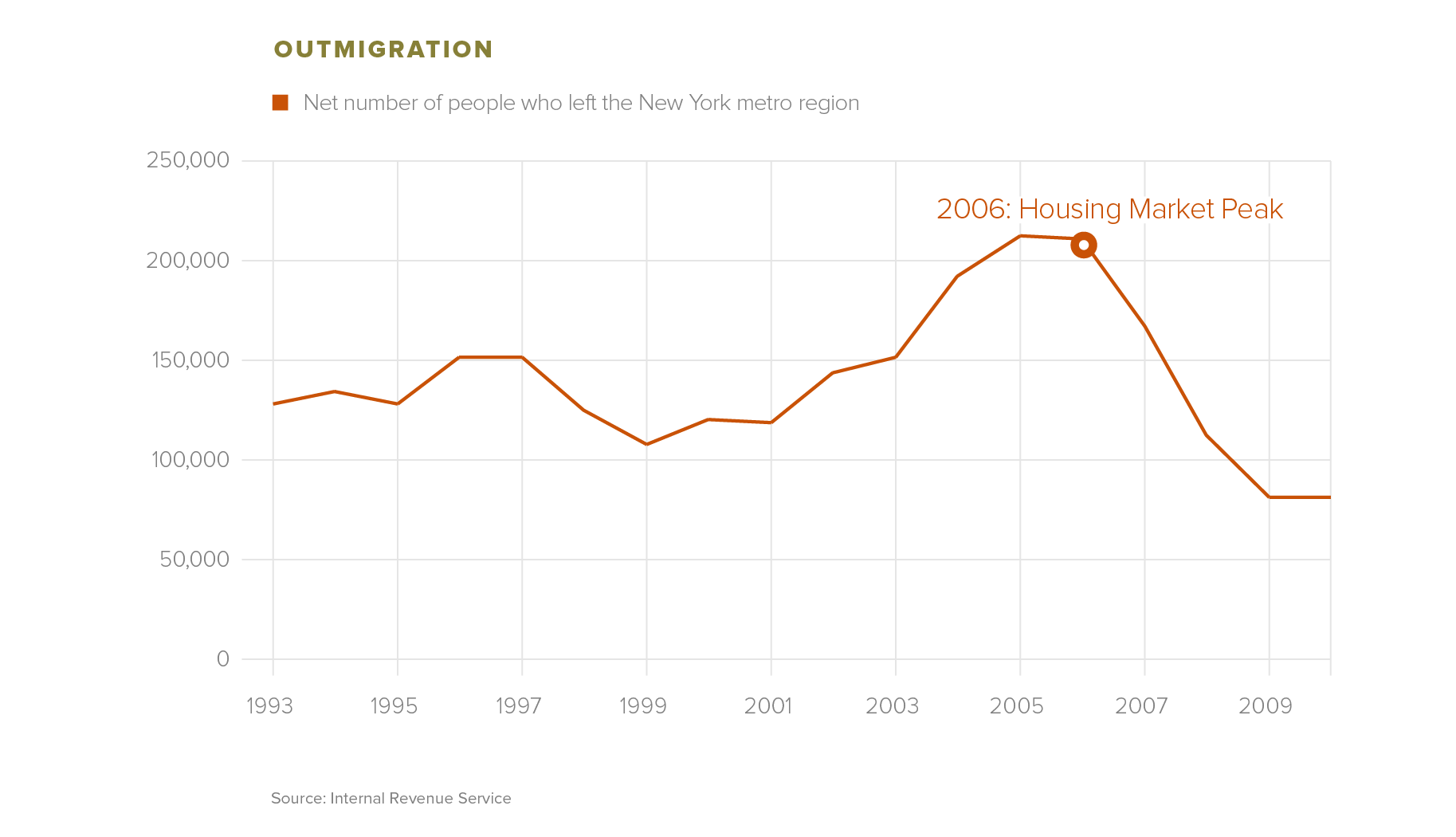

The region has always been expensive and crowded, and improvements in the economy and quality of life drive up prices and attract more residents and businesses. But when incomes don’t keep pace with prices, or if the hassles of living here outweigh the advantages, it becomes harder to attract and retain talented workers. Indeed, the peak of the real estate market of the mid-2000s, when housing was most expensive, coincided with the peak of migration out of the region.

SCROLL TO LEARN MORE

SCROLL TO LEARN MORE

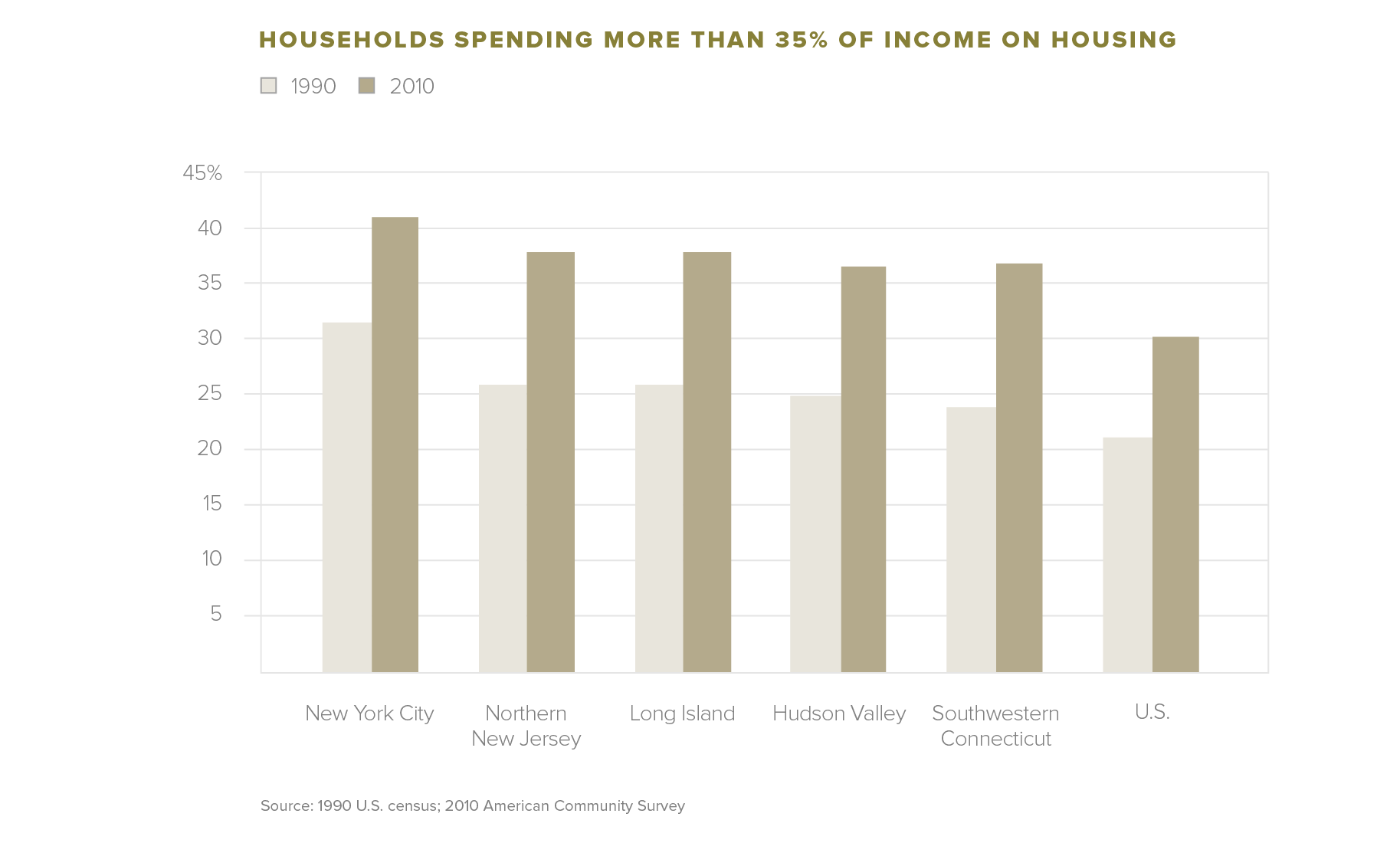

Declining incomes have been compounded by skyrocketing housing costs.

Today, nearly four in 10 households spend more than 35% of their income on housing, up from less than three in 10 in 1990. An increase in the cost of housing is a national trend, but it is more pronounced in this region. These costs are cushioned by relatively low transportation costs, thanks to our excellent public-transit system, but combined housing and transportation costs still account for almost half of household budgets.

The lion’s share of household income goes to housing, transportation and taxes, leaving little for other important expenses.

Discretionary income is the amount left over after taxes, transportation and housing expenses, have been subtracted from median household income. The amount of discretionary income available to the average household for food, medical expenses, child care, education and other expenses ranges from $17,000 per year in the Bronx to $39,000 in Somerset County, N.J; the variation is even greater in between neighborhoods.

Counties with the highest average incomes also have the highest amounts of discretionary income. As expected, income taxes are highest where incomes are greatest. Transportation costs are highest where transit use is lowest. Housing costs, in dollar terms, were generally highest where incomes were highest, but with more variation.

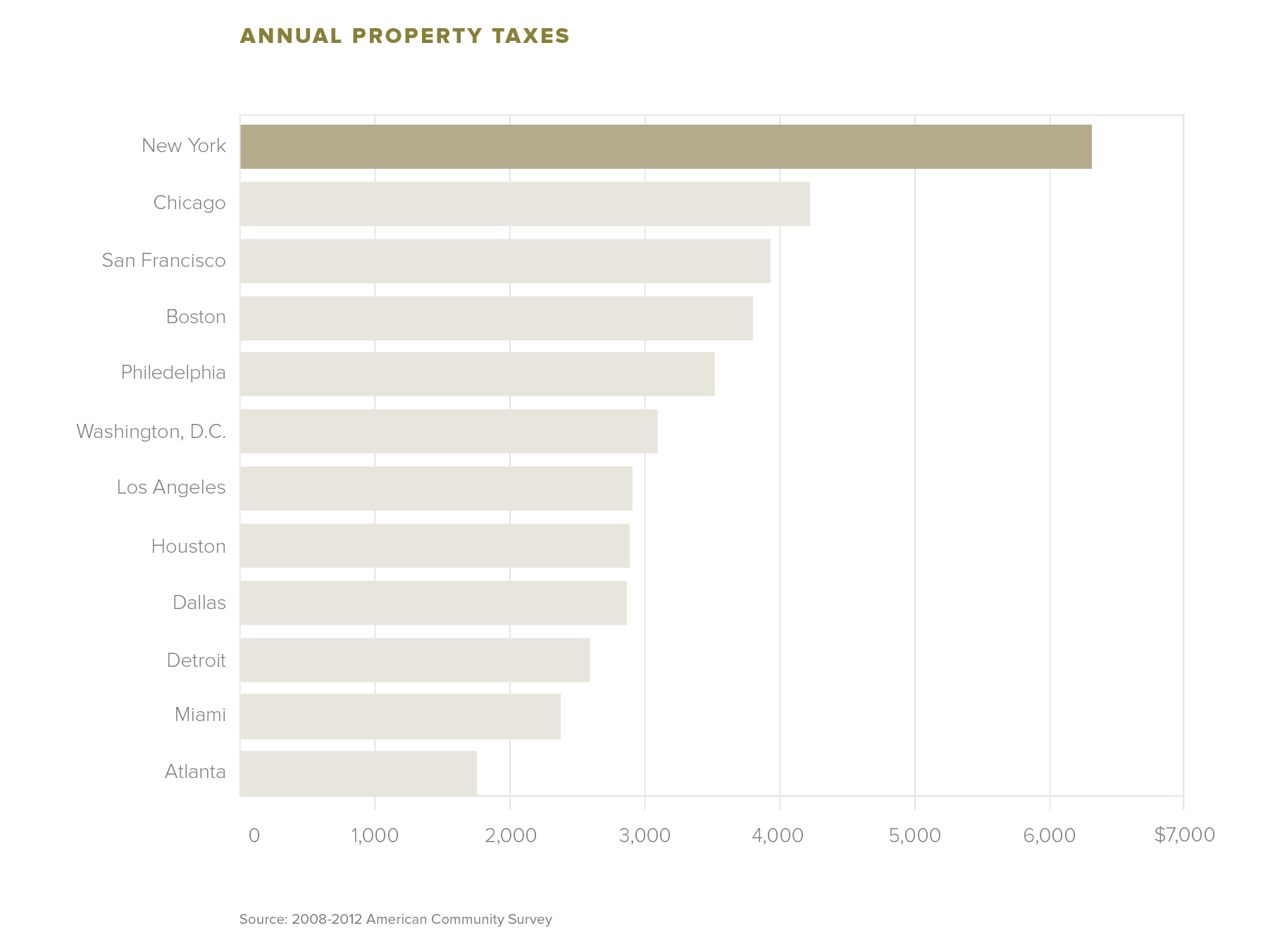

The region places an excessive reliance on property taxes to fund government services.

The extent of government services – especially education – funded by local property taxes is greater than in many other parts of the country. This contributes to property taxes in suburban counties such as Nassau and Westchester to be among the highest in the nation. Rising health care costs for both active and retired employees and high pension costs also put pressure on local property tax levies. In areas where property values are relatively low, the high property tax rate as a percentage of property value has the effect of deterring the entry of new businesses.

Affordability is one of the biggest concerns for the region’s residents.

‘We never feel like we have enough money to put down on a house. I feel like we never get ahead, we’re just always kind of just keeping our heads above water. And it’s sad because you feel like you want to give your child more, rather than just moving from rental to rental.’ – Deborah, Fairfield County, Conn.

Migration from the region increased during the red-hot real-estate market of the mid-2000s in spite of the strong economy.

During the real estate boom of the 2000s, outmigration increased as housing prices rose and declined when prices dropped. While some homeowners were able to sell their home at a profit and move elsewhere, renters and new households had fewer affordable options.

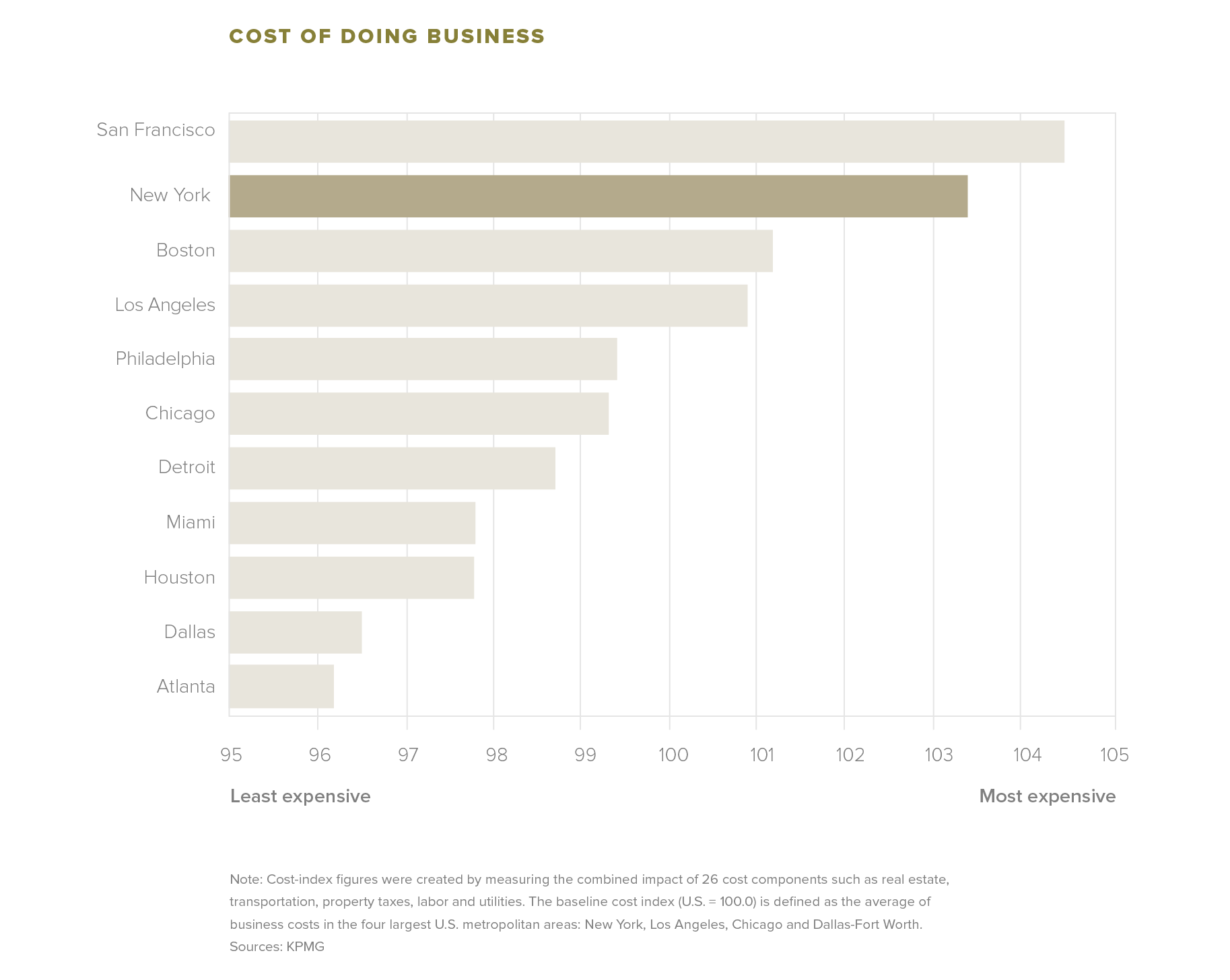

The high cost of living here also makes it more costly to do business.

Everything from labor to taxes to office space costs more here than in most regions. This is typical for metropolitan areas with high-value industries and high education levels, but the expense can make it particularly difficult to retain middle-income jobs and support entrepreneurs.